Average House Price by State in 2022 The Ascent by Motley Fool

Table of Content

So, instead of waiting for much lower prices, buy a home based on your budget and needs. If you find a home you love in an area you love, and it also fits your budget, then chances are it might be right for you. However, if you make too many sacrifices just to get a house, you may end up with buyer’s remorse and an expensive albatross you might have to offload. A key difference now compared to the last housing crisis is that many homeowners, and even those struggling to make payments, have had a large boost to their home values in recent years.

Today, the median home value in the U.S. real estate market is now $357,589. Hovering around 6.49% with 2023 just around the corner, the average commitment rate on a 30-year fixed-rate mortgage is up 3.38 points year-over-year. The increase was intended to stall the blistering pace of the housing sector, and the plan worked. Mortgage applications have declined in the wake of higher rates and buyers are less inclined to purchase a home with a recession appearing all but inevitable. At the same time, homeowners are reluctant to sell and trade their current mortgage rates for today’s inflated rates. In a way, it is almost too expensive for homeowners to sell their on properties.

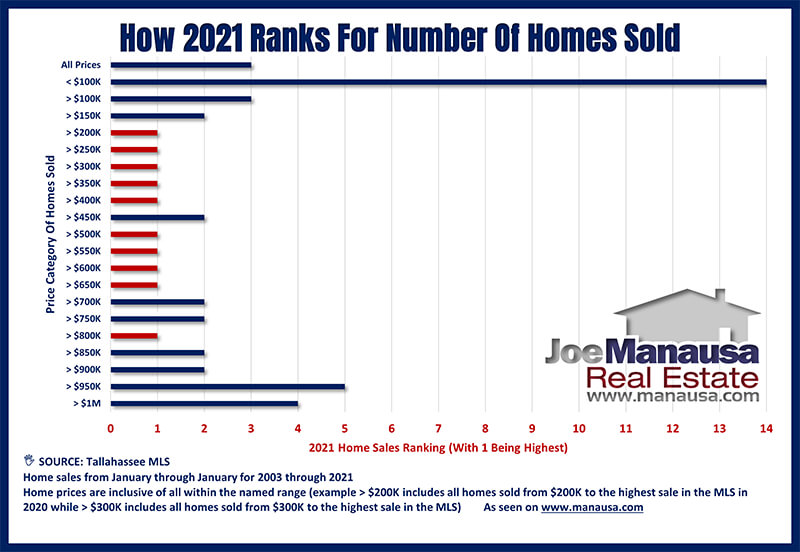

Housing-Market Mayhem: U.S. Home Sales Likely to Hit Record High of $2.5 Trillion In 2021

Due to higher acquisition costs, few foreclosures , lower profit margins, and even lower borrowing costs, today's investors are increasingly turning to building rental property portfolios. Access to affordable institutional money has enabled today's investors to simultaneously offset higher prices and increase monthly cash flow from properties placed in operation. To stimulate the real estate market and prevent a total collapse, the Fed dropped interest rates to their lowest levels ever. The move catalyzed buyers, and pent-up demand encouraged prospective owners to participate in the market. It should be noted, however, that demand quickly turned into competition.

This resulted in one of the biggest seller's markets in history, although that may be changing as mortgage rates increase and housing supply expands. Now, let's take a deeper dive into what average house prices are like across the country. With homebuyers active and supply still lacking, the current trend of home prices will not see a reversal. In the last quarter of half of 2022, we are seeing a gradual shift in the real estate market away from sellers to more balanced conditions, with a rise in the number of properties entering the market. Existing-home sales descended in September, the eighth month in a row of declines. The market is heading to cool off, but house prices will not necessarily fall like crazy.

Housing Market News

He’s also the host of the top-rated podcast – Passive Real Estate Investing. Annual price increase was greatest in North Port-Sarasota-Bradenton, FL, where the price increased by 29.2 percent. We're firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. In recent history, that outlier was the Great Recession, which caused both median and mean home prices to drop.

The U.S. real estate market has experienced every end of the housing spectrum over the last decade. More than ten years ago, real estate market trends bottomed out during the Great Recession. For the better part of this year, competition fueled what looked like the hottest housing market prices the industry had ever seen. Buyers were forced to compete with several offers on every property, drastically tilting the scales in favor of sellers.

Will Home Prices Drop in the United States?

Price indicates that the housing market is competitive and bidding wars are becoming more common. Tayenaka points to the outsize number of homes falling out of escrow recently as a cautionary tale for sellers who continue to demand 2021 prices. The first step for a successful sale is to find a listing agent who knows the area and comes highly recommended. A good agent will work closely with you to price your home competitively while fielding questions and offers from prospective buyers. Use a mortgage calculator to estimate your monthly housing costs based on your down payment and interest rate. There are mixed signals from economists about if and when the housing market will crash, or if it will simply “correct” itself from the double-digit percentage jumps seen in home prices the past year.

While Alabama has a low median income (19% below the national median), its typical house prices are even lower. Because of that, residents don't pay too much for their mortgages. The top U.S. real estate markets in 2022 are directly correlated to the new marketplace created in the wake of the Coronavirus.

Many housing insiders warn buyers against trying to time the market as the economy wades through its current period of uncertainty. Marco Santarelli is an investor, author, Inc. 5000 entrepreneur, and the founder of Norada Real Estate Investments – a nationwide provider of turnkey cash-flow investment property. His mission is to help 1 million people create wealth and passive income and put them on the path to financial freedom with real estate.

A CMA is a free report prepared personally by one of our agents that compares your home to similar properties in your neighborhood that are currently for sale or have recently been sold. Because homes represent the largest single purchase most people will make in their lifetime, it’s crucial to be in a solid financial position before diving in. Other experts point out that today’s homeowners stand on much more secure footing than those coming out of the 2008 financial crisis, so the likelihood of a housing market crash is low. In the meantime, the ongoing slowdown in new construction is squeezing the already limited housing supply.

Housing supply will decrease in 2023 to maintain upward pressure on home prices as single-family homebuilding sees a decline next year. In October, the NAHB homebuilders group announced that homeowner confidence has dropped for the tenth consecutive month. When applying for a mortgage, homebuyers with a FICO® Score of 760 or higher typically qualify for the lowest mortgage rates.

The median income (24% more than the national median) hasn't been able to match home prices in Utah. That makes home ownership difficult for many residents because of high average mortgage payments. Tennessee’s lower-than-average housing costs isn’t enough to compensate for incomes 19% under the national median.

Comments

Post a Comment